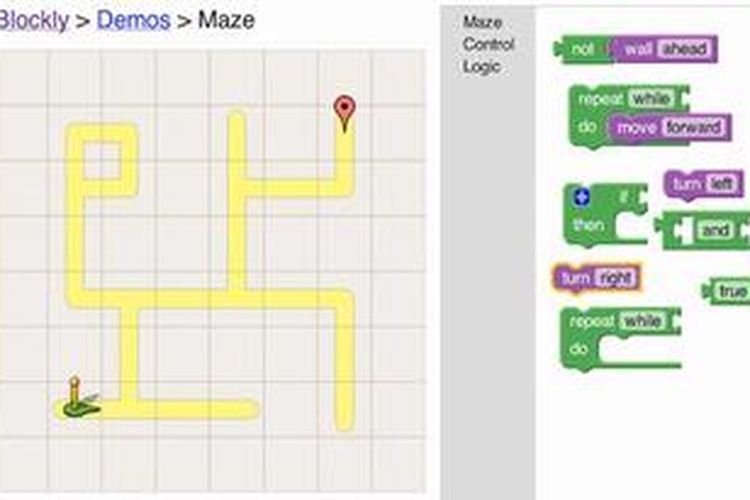

Blockly: Revolutionizing Visual Programming for Learners and Developers

In the rapidly evolving world of software development and education, tools that simplify coding and make it accessible to all are in high demand. Among the most influential of these…