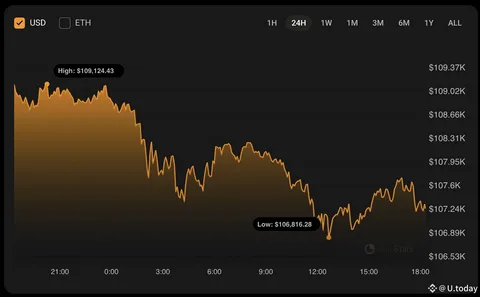

What Is “BTC Price”?

When people say “BTC price,” they refer to the market value of a single Bitcoin expressed in a fiat currency — typically U.S. dollars. That number changes constantly as buyers and sellers trade Bitcoin on exchanges worldwide.

Because Bitcoin is decentralized — it’s not controlled by any central bank or government — its price depends entirely on market forces: demand, supply, investor sentiment, macroeconomic events, regulation, and more.

A Quick History of Bitcoin’s Price Movements

-

In early days (2009–2012), Bitcoin’s price was near zero. As adoption began, it started climbing slowly.

-

By 2013, Bitcoin passed $1,000 — a major milestone.

-

The 2017 bull run sent BTC to nearly $20,000 before a sharp crash.

-

In the years after, Bitcoin went through cycles of growth, consolidation, decline, and recovery — influenced by global macro factors, regulation, and changing investor sentiment.

-

As of now, BTC remains a major asset in crypto markets — and its price continues to swing significantly.

This bizarre roller-coaster history is part of what makes Bitcoin both fascinating and risky.

What Determines BTC Price? — Key Drivers

1. Supply and Demand

Bitcoin has a fixed maximum supply — only 21 million coins will ever exist.

When demand outpaces supply — due to growing adoption, institutional interest, or market hype — price goes up. If demand weakens, price falls.

2. Market Sentiment & Speculation

Crypto markets react strongly to belief, hype, fear, and speculation. Positive news (e.g. institutional adoption, regulatory clarity) tends to drive demand, while negative news (crackdowns, hacks, macroeconomic uncertainty) often triggers sell-offs.

3. Macro Factors — Liquidity, Interest Rates & Global Economy

Wider economic conditions matter. For instance:

-

Low interest rates or loose monetary policy can push investors toward risk assets like Bitcoin.

-

Economic instability or inflation fears might drive people to seek alternatives.

-

Conversely, rising interest rates or economic tightening can reduce demand for volatile assets.

4. Regulatory & Institutional Developments

Because crypto operates globally and sometimes outside traditional financial regulation, announcements by governments or regulators — or acceptance by major financial institutions — can heavily impact price.

5. Competition & Alternative Cryptocurrencies

New cryptocurrencies (altcoins), innovation in blockchain, and shifting trends in the crypto ecosystem can divert attention (and money) away from Bitcoin — affecting its demand and value.

6. Market Liquidity, Leverage & Trading Activity

Bitcoin’s price is sensitive to how much trading volume there is, how much leverage traders use, and how easily Bitcoin can be bought/sold. High liquidity tends to reduce extreme swings; low liquidity can amplify volatility.

Why BTC Price Is So Volatile

Bitcoin is far more volatile than traditional assets (stocks, gold, bonds). That’s because its price is influenced by all the factors above — many of which shift abruptly.

-

Rapid swings in demand — e.g. due to a news event.

-

Changes in macroeconomic outlook or global risk sentiment.

-

Regulatory announcements or legal decisions.

-

Market sentiment swings — fear and greed can lead to extreme buying or dumping.

This volatility means big gains are possible — but so are steep losses.

What BTC Price Means to Investors & Traders

For Long-Term Investors (“HODLers”)

-

BTC can be seen as a speculative digital asset or “digital gold.”

-

Over long periods, cycles of boom and bust may smooth out.

-

Some investors view long-term dips as buying opportunities.

For Traders / Short-Termers

-

Volatility creates opportunities to profit — through swings, leveraging, or derivatives trading.

-

But it demands discipline, risk management, and readiness for rapid market moves.

For Institutions & Portfolio Diversification

-

Adding a small allocation of BTC to a broader portfolio can increase potential returns — but also increases overall risk.

-

As crypto markets mature and institutional participation grows, some volatility may moderate over time.

What to Watch if You’re Tracking BTC Price

If you follow Bitcoin price, keep an eye on:

-

News & global macro developments — interest rate changes, inflation, economic stability.

-

Regulatory environment — laws, bans, acceptance of crypto by countries.

-

Institutional flows — big investments, ETFs, crypto-aware funds.

-

Supply and demand signals — Bitcoin halving cycles, mining costs, availability.

-

Market sentiment — how people feel about crypto, social media trends, investor confidence.

-

Liquidity & trading volume — low volume can cause big swings, high volume may stabilize price.

Being aware of these helps make sense of why BTC price moves — and reduces the shock when it does.

Risks & Why Bitcoin Price Isn’t Guaranteed to Go Up

-

Extreme volatility: Price swings can lead to large losses.

-

Regulatory risk: Governments might impose restrictions, bans, or taxes.

-

Competition: Other cryptocurrencies or blockchain technologies may erode Bitcoin’s dominance.

-

Sentiment-driven bubbles: Without concrete fundamentals, price bubbles can form — and burst.

-

Macroeconomic vulnerability: Changes in global economy can drag BTC down alongside other risky assets.

Because Bitcoin’s value depends so heavily on perception and external factors, there’s no guarantee its price will always trend upward.

Conclusion — Is BTC Price Worth Watching?

Yes — but with eyes wide open. Bitcoin remains one of the most volatile, high-potential assets in the world. Its price can soar to extreme highs or crash dramatically in a short time.

For long-term believers in Bitcoin’s future (digital gold, store of value, decentralized currency), BTC offers a unique, high-reward—but also high-risk—opportunity. For traders, the volatility can create chances for profit (and loss).

If you track BTC price or consider investing, it helps to understand why price moves — not just what it is. That way, you approach crypto with insight, not hype.