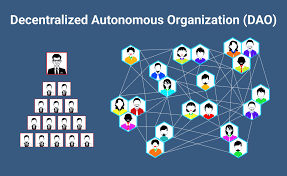

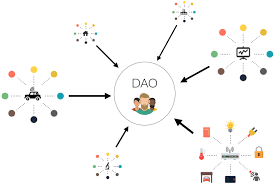

In the last few years, there has been a lot of buzz around DAOs (Decentralized Autonomous Organizations) in the world of blockchain, Web3, decentralized finance (DeFi), and digital communities. But what exactly is a DAO? How do they work, why are people excited about them, what are the risks, and could they reshape how we organize ourselves—both online and offline? Let’s explore.

What Is a DAO?

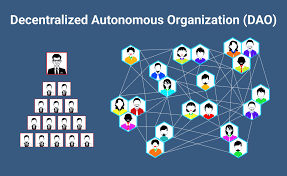

A DAO, or Decentralized Autonomous Organization, is an organization run through rules encoded as computer programs called smart contracts on a blockchain. Instead of being managed by a central authority (like a CEO or board of directors), decision‑making power is distributed among its members. Members participate by proposing ideas, voting on them, and executing changes via code.

Here are its core defining features:

-

Decentralized governance: No single person or small group has overriding control. Governance typically depends on token‑holders with voting rights.

-

Autonomous operation: Much of what happens is automatic once rules are set in smart contracts. The code executes actions based on voting outcomes, fund flows etc., without manual intervention. Encyclopedia Britannica+2Binance Academy+2

-

Transparency: All rules and transactions are visible on the blockchain. Anyone can audit, inspect proposals, votes etc. Binance Academy+2Avast+2

-

Member‑driven proposals and voting: Members propose changes, vote, and the decisions are executed automatically once consensus (or whatever governance rule) is reached. Binance Academy+2blockchaininsights.org+2

In short, imagine a club or a company, but instead of being run by a small hierarchy, it’s run by many people, with rules in code, decisions via voting, and operations largely automated.

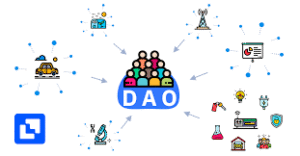

How DAOs Actually Work

To understand DAOs well, it helps to see the main components and workflow.

Key Components

-

Smart Contracts: These are pieces of code deployed on blockchain(s) that define the rules of the DAO. For example, how proposals are made, how votes are counted/weighted, how funds are handled. Once deployed, these contracts execute automatically based on conditions. Binance Academy+2Encyclopedia Britannica+2

-

Token(s): Governance tokens or membership tokens are issued. Holding these tokens usually gives you the right to vote or otherwise participate. The more tokens you hold, often the more influence (though different DAOs implement different schemes). Investopedia+2Binance Academy+2

-

Treasury / Fund Pool: Many DAOs have a treasury—crypto or tokens—that they can use to fund projects, pay contributors, etc. Proposals for spending or investments go through the DAO’s governance process. Binance Academy+2World Economic Forum+2

-

Proposals & Voting Process: Members submit proposals (to change rules, allocate funds, hire contributors, etc.), then the community votes. If a proposal passes (according to preset rules like minimum votes, quorum, etc.), then smart contracts execute the decision. Binance Academy+1

-

Governance Rules: These are encoded in contracts. They define what percentage is needed for a proposal to pass, what quorum (minimum number of votes), delegation rules (sometimes token holders can delegate their voting power), whether voting is weighted by token stake or equal one member one vote, etc. Wikipedia+2blockchaininsights.org+2Workflow / Typical Lifecycle

-

Formation: A DAO is created (rules written, smart contracts deployed). Sometimes initially a small core team writes the first contracts, defines tokenomics and membership rules.

-

Token Distribution: Tokens for governance are distributed/sold or given. This is how members get voting power.

-

Proposal Stage: Members propose ideas – this can be technical changes, budget proposals, community initiatives, etc.

-

Voting: Token holders vote according to the governance rules.

-

Execution: Once a proposal passes, smart contracts enforce the result (e.g., transfer funds, change parameter, etc.).

-

Iteration / Growth: Over time, DAOs can evolve, perhaps update their smart contracts, change governance models, etc., often via further proposals.

Types & Use Cases of DAOs

DAOs are not all the same. They serve many different purposes. Here are common types and real examples, to show how diverse the field is. Encyclopedia Britannica+2dtcgroup.io+2

Types

-

Protocol / Infrastructure DAOs: These govern blockchain protocols, DeFi projects, etc. e.g., Uniswap DAO, MakerDAO. These DAOs vote on changes to the protocol, fees, upgrades, etc. Wikipedia+1

-

Investment DAOs: Groups of people pooling funds to make investments—whether in other projects, startups, or crypto assets. Decisions are made by voting. Members share in the returns. Encyclopedia Britannica+1

-

Grant / Funding DAOs: These are formed to fund projects, often in open source or community work. Community members decide which projects get grants. Encyclopedia Britannica+1

-

Service DAOs: DAOs that offer services to other entities—design, marketing, smart contract audits, consulting etc.—in a decentralized manner. The members are service providers. dtcgroup.io+1

-

Social / Collector / Collector‑Asset DAOs:

-

Social DAOs are community‑driven around shared interest, culture, Web3 identity, events etc. dtcgroup.io

-

Collector DAOs pool funds to buy digital art, NFTs, collectibles, or other assets, and then manage the collection collectively. dtcgroup.io

-

Real‑Life Examples

-

The DAO (2016): One of the earliest and most famous attempts. It was a large investment DAO built on Ethereum. It raised huge funds by ICO, but then was hacked due to vulnerabilities in its smart contract, leading to a major controversy and a split (hard fork) in Ethereum. Wikipedia+1

-

MakerDAO: Governs the DAI stablecoin, where holders of MKR tokens vote on various parameters of the protocol. Wikipedia+1

-

PleasrDAO: A collector DAO which purchases high‑value NFTs / digital art as a collective, with members sharing ownership and decisions. dtcgroup.io

Benefits / Advantages

Why do people find DAOs exciting? What potential do they offer over more traditional organizational forms? Here are the major advantages:

-

Decentralization & Democracy

DAOs distribute power among members rather than concentrating it. This can reduce the risk of corruption, nepotism, or centralized failure. All members have (in principle) a voice. Encyclopedia Britannica+1 -

Transparency

Because operations, finances, and voting are on the blockchain, everything is auditable. Members can see exactly what happened, when, and by whom. This builds trust. Binance Academy+1 -

Global & Inclusive Participation

Anyone with internet and the relevant tokens can participate, regardless of geography. This opens up organizations across borders without needing a central office. Avast+1 -

Automation / Efficiency

Smart contracts enforce rules automatically. Once a proposal passes, changes happen without needing middle‑management to implement them. This can reduce overhead, delays, human error. Binance Academy+1 -

Alignment of Incentives

Members often have stake via tokens, which means they have financial or reputational incentive to act in the DAO’s best interest. This may promote engagement and responsible governance. dtcgroup.io+1 -

Experimentation with New Governance Models

DAOs are experimenting with novel ways of making decisions: quadratic voting, delegated voting, token‑based vs membership‑based governance etc. These experiments can teach us new models of democracy, cooperation, organization. arXiv+1

Risks, Challenges & Limitations

While the promise is large, DAOs are not without significant challenges. Many of the potential pitfalls are already being seen in real life. Here are the main issues:

-

Smart Contract Vulnerabilities

Since rules are in code, bugs or design flaws can have disastrous consequences. The original “The DAO” hack is a prime example. Wikipedia+1 -

Legal Uncertainty / Regulation

Because DAOs do not fit neatly into existing legal frameworks, issues arise regarding liability, legal status, taxation, compliance with securities laws etc. Depending on country, it may not be clear who can be sued, how profits are taxed, etc. Wikipedia+2World Economic Forum+2 -

Participation & Governance Problems

-

Low voter turnout: many token holders do not vote, leading to governance decisions being made by a small active minority. Wikipedia+1

-

Token concentration: those with large token holdings have disproportionate influence, undermining decentralization. Wikipedia+1

-

Proposal spam or poor quality proposals can clog governance.

-

-

Scalability & Decision‑making Speed

As DAOs grow, more proposals, more members, more complex decisions—they may slow down. Reaching consensus can be slow, and executing changes may require updates to smart contracts. -

Security Risks / Attack Vectors

Besides smart contract bugs, there are risks like governance attacks (someone acquiring many tokens, hijacking votes), sybil attacks (fake identities), or external threats. LBank+1 -

User Experience / Technical Barriers

It’s not trivial for many people to interact securely with blockchain, manage wallets, understand gas fees, smart contract permissions, etc. These user‑experience issues can limit adoption. -

Regulatory & Jurisdictional Barriers

Different countries have different laws about digital assets, token sales, collective governance, securities. DAOs operating across borders may face complex legal issues. Wikipedia+1

Empirical Data & State of the DAO Ecosystem

To get a sense of how big DAOs are now, what behaviour is emerging, and how they’re performing in practice, here are some key findings from recent studies:

-

A large‑scale empirical study (2024) looked at >13,000 DAOs, with around US$24.5 billion in total value locked (treasuries) and over 11 million governance token holders. arXiv

-

That same study shows that DAOs vary widely in how decentralized they actually are. Some are very decentralized, others have big power imbalances. Where voting power is concentrated, the DAO is less truly decentralized. arXiv

-

Also, DAOs with higher grassroots participation tend to be more decentralized. That means engaging more token‑holders, lower concentration of power, is correlated with better decentralization metrics. arXiv

This shows that while the ideals are high, the practice is mixed—and that designing a good DAO is hard.

Legal, Ethical, Social Considerations

Besides purely technical and economic challenges, DAOs raise many legal, ethical and social questions:

-

Liability: Who is responsible if something goes wrong (fraud, loss of funds, governance errors)? Are token holders liable? Are core contributors? Some jurisdictions (like Wyoming in the USA) have started recognizing DAOs as legal entities. Wikipedia+1

-

Regulatory Classifications: Are governance tokens securities? Are they assets? Depending on how a DAO is structured, regulators may treat them differently. Non‑compliance can result in legal risk. Investopedia+1

-

Fairness & Representation: Does one token = one vote? Or does more token ownership equal more votes? What about delegates? Are minority voices heard? Are tokens sold unfairly or hoarded? These questions affect how “democratic” a DAO really is.

-

Ethics of Transparency vs Privacy: Transparency is good, but what about privacy? Some voting records, addresses etc., are public. Participants may lose privacy. There’s a tension between full on‑chain transparency and personal safety / privacy.

-

Governance Attacks and Manipulation: Risk of vote buying, bribery, or someone accumulating tokens to push their agenda. Also, proposal manipulation or spam can degrade quality.

What Makes a “Good” DAO?

Given these trade‑offs, what are characteristics of DAOs that tend to work better in practice? Based on empirical data and expert opinion, here are some elements:

-

Clear, Well‑Audited Smart Contracts

Minimize bugs by rigorous auditing, use of tested libraries, modular design. -

Fair Token Distribution & Governance Design

Distribute governance tokens in a way that avoids over‑concentration; implement voting systems that encourage participation; maybe delegate voting. -

Good Incentive Structures

Incentives for voting, for participation, for contribution. If only token holders benefit without effort, engagement drops. -

Active Community & Communication

A DAO needs engaged members, good communication channels (Discord, forums, etc.), transparency in decisions and operations. -

Legal and Regulatory Awareness

Being aware of jurisdictional requirements, having legal frameworks (if needed), recognizing tax and liability implications. -

Adaptive Governance

Ability to evolve rules, update smart contracts, adjust governance methods as needed. -

Security & Risk Management

Regular audits, threat modelling, emergency mechanisms (e.g. “pause” functions in contracts), multisig wallets for treasuries etc.

Use Cases & Examples

Here are some domain‑areas where DAOs are being used or explored, with examples:

| Domain | What DAOs Do | Example(s) |

|---|---|---|

| DeFi / Protocol Governance | Vote on upgrades, risk parameters, fees, new features. | MakerDAO (govern DAI parameters), Uniswap governance. Wikipedia+1 |

| Collective Investment | Pool funds for ventures, early‑stage startups, NFTs etc. | Investment DAOs; PleasrDAO for digital art etc. dtcgroup.io |

| Grant Funding / Public Goods | Fund open source, community projects, or social impact. | Many grant DAOs exist to support public goods in crypto/Web3. World Economic Forum+1 |

| Service Provision | Offer services (e.g., development, design, marketing) via community of contributors. | Service DAOs that compete with traditional agencies. dtcgroup.io |

| Collectibles / Art / Culture | Acquire, manage, show or share artistic works, NFTs. Also operate fan communities, events etc. | Collector DAOs; Social and cultural DAOs. dtcgroup.io |

The Future of DAOs: What to Expect

DAOs are still a relatively new organizational form. Based on current trends and research, here are areas where we can expect growth, change, or innovation:

-

Better Governance UX / Tools

Tools will improve to make proposing, voting, delegating easier for non‑technical users. More intuitive dashboards, less friction. This helps increase participation. -

More Legal Clarity

Jurisdictions will adopt laws that recognize DAOs, define liability, taxation, etc. Some already are. As legal frameworks mature, more mainstream adoption may follow. -

Hybrid Models

Fully decentralized may not always be best. Some DAOs may adopt mixed or hybrid models: some centralized roles for efficiency, but broad governance for key decisions. -

Advanced Voting Mechanisms / Governance Innovation

For example, quadratic voting, VOCs (Voice of Contributors), reputation‑based voting, time‑weighted votes, etc. Also ways to prevent governance capture. -

Interoperability & DAO Ecosystem Integration

DAOs may integrate more with existing institutions, traditional businesses, perhaps even governments. They may collaborate, share resources, or be incorporated into traditional legal frameworks. -

Scaling Issues & On‑Chain Efficiency

As DAOs govern more assets, more people, more proposals, scaling both technically (blockchain throughput, gas fees etc.) and socially (decision speed, member engagement) will become crucial. -

Security and Resilience

Better auditing, standards, insurance and risk‑mitigation for DAOs. Possibly DAO insurance, standardization of contract templates etc. -

Novel Use Cases Outside Crypto

While most current DAOs are crypto/Web3 entities, we may see DAOs in other fields: community governance, charities, arts, cooperatives, even governance in local communities.

Risks & What Could Go Wrong

To be balanced, here are scenarios where DAOs might fail or underperform:

-

Governance Capture: A few individuals acquiring large token holdings could control the DAO. Even if rules are there, influence might still be concentrated.

-

Low Engagement: If many token holders don’t vote, those who do have outsized power. Decisions might reflect only a small active fraction, hurting legitimacy.

-

Smart Contract Exploits: Bugs or malicious vulnerabilities can lead to loss of funds (as the original “The DAO” hack showed).

-

Regulatory Clampdown: If regulators decide that governance tokens are securities, heavy regulation could hamper operations. Or tax treatment may be burdensome.

-

Coordination & Efficiency Issues: For large or complex decisions, reaching consensus may be slow; too many proposals might overwhelm members; or the cost (in time, gas fees) of participating may be high.

-

Legal Liability for Members: If a DAO is not recognized as a legal entity, are members personally liable for actions of the DAO? Token holders might find themselves in legal grey areas.

Should You Join or Build a DAO?

If you’re thinking whether it makes sense for you to get involved in a DAO, here are some thoughts to guide you:

What you should consider

-

Purpose / Mission: Does the DAO have a mission you believe in? Are you aligned with its goals or values?

-

How Governance Works: What is the voting model? How are tokens distributed? Is there a risk of centralization? Are proposals high quality?

-

Contribution vs Reward: What do you bring to the DAO (time, skills, capital)? What do you get in return (financial rewards, governance influence, reputation, learning)?

-

Risk Tolerance: Are you okay with volatility, uncertain legal status, potential loss?

-

Technical Comfort: Are you comfortable with wallets, interacting with blockchain, managing security (private keys etc.)?

If you want to build a DAO

-

Start with a clear mission and governance model.

-

Design tokenomics carefully (how tokens are distributed, how voting power is weighted).

-

Define proposal & voting rules, quorums etc.

-

Use audited smart contracts, possibly open‑source templates.

-

Set up communication channels, community engagement.

-

Think about legal structure: Should you register somewhere? How to manage liability?

Conclusion

DAOs represent a powerful and novel way for people to coordinate, make decisions, and move resources together in a democratic and transparent way. They challenge many assumptions of traditional hierarchical organizations and open up possibilities for new forms of collaboration and governance.

But DAOs are not magical—they have real trade‑offs. There are risks in implementation, in governance design, in legal status, in security, and in human behaviour. Some DAOs will thrive, others may fail or become centralized in practice despite decentralization in principle.

If the challenges are met—better tools, legal clarity, good design, active communities—DAOs could transform how we think about organizations, governance, cooperation, and even democracy.