In the fast-evolving world of financial markets, the intersection of technology and trading has given rise to a new breed of firms—quantitative trading powerhouses that use cutting-edge algorithms, big data, and robust infrastructure to capture opportunities across global markets. Among these trailblazers, Radix Trading stands out as a leader, particularly in the burgeoning space of digital assets. This article explores Radix Trading’s origins, strategies, impact on digital asset markets, and what sets the firm apart in a landscape defined by rapid innovation and relentless competition.

The Genesis of Radix Trading

Radix Trading was established in 2015 by a group of seasoned traders and technologists who previously held influential roles at DRW, one of the world’s most prominent proprietary trading firms. Founded by Ben Blander and Trey Griggs, Radix Trading was built on the belief that a scientific, data-driven approach to markets could deliver superior results, especially as markets became increasingly electronic and complex.

From its inception, Radix Trading has operated with a global mindset. Though headquartered in Chicago, the firm quickly expanded its reach to major financial centers around the world, trading a diverse array of products including equities, futures, options, and most notably, digital assets such as cryptocurrencies.

Quantitative Trading: The Heart of Radix’s Strategy

At the core of Radix Trading’s success lies its commitment to quantitative trading—using mathematical models, statistical analysis, and algorithmic systems to identify and exploit patterns in financial markets. This approach enables Radix to process vast amounts of data in real time and to execute trades with precision and speed that would be impossible for human traders alone.

The firm’s quantitative strategies are developed by teams of researchers, data scientists, and engineers who design and rigorously test algorithms under a variety of market conditions. These strategies range from market making and arbitrage to trend-following and mean reversion, all underpinned by a robust risk management framework.

Entering Digital Asset Markets

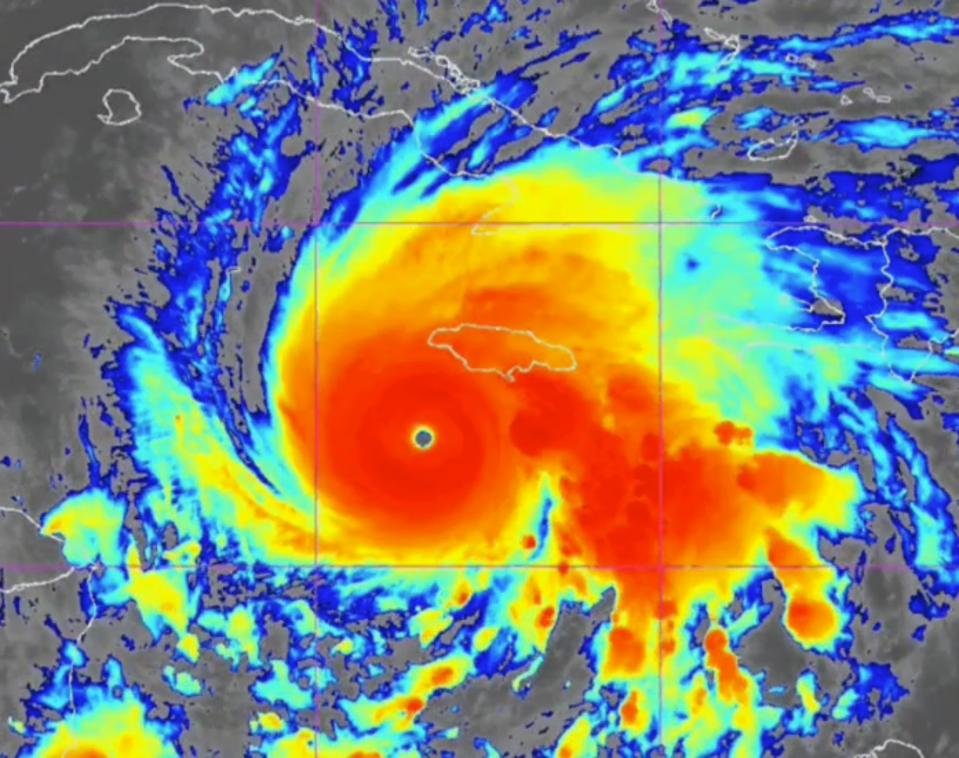

Radix Trading’s entry into digital asset markets marked a significant evolution for the firm. Cryptocurrencies like Bitcoin and Ethereum, as well as a growing universe of altcoins, presented a new frontier—one characterized by extreme volatility, 24/7 trading, and fragmented liquidity across numerous exchanges.

Radix approached this space with the same scientific rigor that defined its traditional market operations. The firm developed proprietary trading systems capable of interfacing with multiple crypto exchanges, aggregating order books, and executing trades at lightning speed. In an environment where milliseconds can make the difference between profit and loss, Radix’s technological edge has proven invaluable.

Market Making and Liquidity Provision

One of Radix Trading’s most important roles in digital asset markets is that of market maker. Market makers quote both buy and sell prices for assets, providing liquidity that allows other participants to trade with minimal price disruption. This function is especially critical in cryptocurrency markets, which can suffer from thin order books and high volatility.

By consistently quoting tight spreads and maintaining deep liquidity, Radix Trading helps stabilize prices and enables smoother trading for both institutional and retail participants. The firm’s market making activities also facilitate price discovery, allowing the market to more accurately reflect the true value of digital assets.

Risk Management in a Volatile Environment

Risk management is at the heart of every decision at Radix Trading. The digital asset space, while lucrative, is notorious for sharp price swings, exchange outages, and regulatory uncertainties. To navigate these risks, Radix employs real-time monitoring systems, position limits, and advanced analytics to ensure that trading activities remain within acceptable risk parameters.

The firm’s approach to risk is both quantitative and qualitative. Algorithms are designed to adapt to changing market conditions, automatically scaling back exposure during periods of high volatility or uncertainty. Meanwhile, human oversight ensures that unforeseen events—such as exchange hacks or sudden regulatory announcements—can be managed with speed and agility.

Regulatory Navigation and Compliance

The regulatory landscape for digital assets is complex and rapidly evolving, with different jurisdictions imposing varying rules on trading, custody, and reporting. Radix Trading has demonstrated a proactive approach to compliance, investing in robust frameworks to ensure adherence to applicable laws and engaging with regulators to help shape industry standards.

This commitment to compliance not only reduces the risk of legal issues but also builds trust with counterparties, exchanges, and institutional clients who are increasingly demanding transparency and accountability from their trading partners.

The Impact of Radix Trading on Digital Asset Markets

Radix Trading’s presence has had a transformative effect on digital asset markets:

- Enhanced Liquidity: By acting as a market maker, Radix deepens order books and narrows spreads, making trading more efficient for all participants.

- Professionalization: The firm’s disciplined, research-driven approach has set new standards for professionalism in crypto trading, encouraging other participants to adopt best practices.

- Innovation: Radix’s technological innovations have driven improvements in market infrastructure, from faster execution systems to more reliable data feeds.

Collaboration and Industry Engagement

Radix Trading is not an isolated actor; it collaborates with exchanges, technology providers, and other trading firms to foster a healthier, more resilient market ecosystem. Through participation in industry groups and open dialogue with stakeholders, Radix helps advance the adoption of standards that benefit the broader digital asset community.

Talent and Company Culture

A key pillar of Radix Trading’s success is its focus on talent and culture. The firm attracts top-tier quantitative researchers, engineers, and traders, offering an environment where innovation and intellectual curiosity are encouraged. Employees are empowered to challenge assumptions, experiment with new ideas, and contribute to the evolution of trading strategies and technology.

Challenges and Future Outlook

Despite its many achievements, Radix Trading faces ongoing challenges. The pace of change in digital asset markets is relentless, with new products, exchanges, and competitors emerging constantly. Regulatory uncertainty, cybersecurity threats, and technological disruptions are ever-present risks.

However, Radix’s adaptive culture, robust technology, and commitment to research position it well to navigate these challenges. As digital assets continue to gain mainstream acceptance and institutional adoption, Radix Trading is poised to play an even more significant role in shaping the future of finance.

Conclusion

Radix Trading exemplifies the fusion of quantitative research, technological prowess, and disciplined risk management that defines today’s most successful trading firms. Its influence on digital asset markets—through liquidity provision, innovation, and professionalism—has helped elevate the industry as a whole. As cryptocurrencies and other digital assets become an integral part of the global financial system, firms like Radix Trading will continue to drive progress, set standards, and unlock new possibilities in trading and beyond.